Fiscal Transparency and Sustainability

This webpage serves to educate Cerritos residents on key aspects of the City's budget that drive how we do business now and into the future.

Overview

The City of Cerritos is committed to responsibly managing our public resources that support our long-term financial goals and strengthen our future. This commitment to fiscal transparency and sustainability is prioritized in our Strategic Plan and is symbolic of our Cerritos in Progress theme. We invite Cerritos residents to become more familiar with our Fiscal Year 2025-2026 Budget, including key operational expenses and revenues. Through increased fiscal engagement, we’ll progress together in building a bright future for Cerritos.

Jump to:

Service Profile | Budget at a Glance | Expenses | Revenues | Sales Tax | Budget Timeline | FAQs

Supporting Quality Services

The City of Cerritos prides itself in providing quality services to over 48,000 residents, 1,600-plus businesses and frequent visitors. We’re known for our beautiful parks system, state-of-the-art Library, Cerritos Senior Center at Pat Nixon Park, and our renowned Cerritos Center for the Performing Arts. The City is also home to high-performing schools and a bustling business community, which includes the Cerritos Auto Square, Cerritos Towne Center, and Los Cerritos Center.

Cerritos' commitment to achieving high-quality services requires prudent budget analysis and implementation, exemplified through transparent communication and future-focused strategies.

Budget at at Glance

Select the green buttons to view the full documents.

A Budget at a Glance document was mailed to Cerritos residents in December 2025 to provide clarity on projected Citywide expenses and revenues for Fiscal Year 2025-2026.

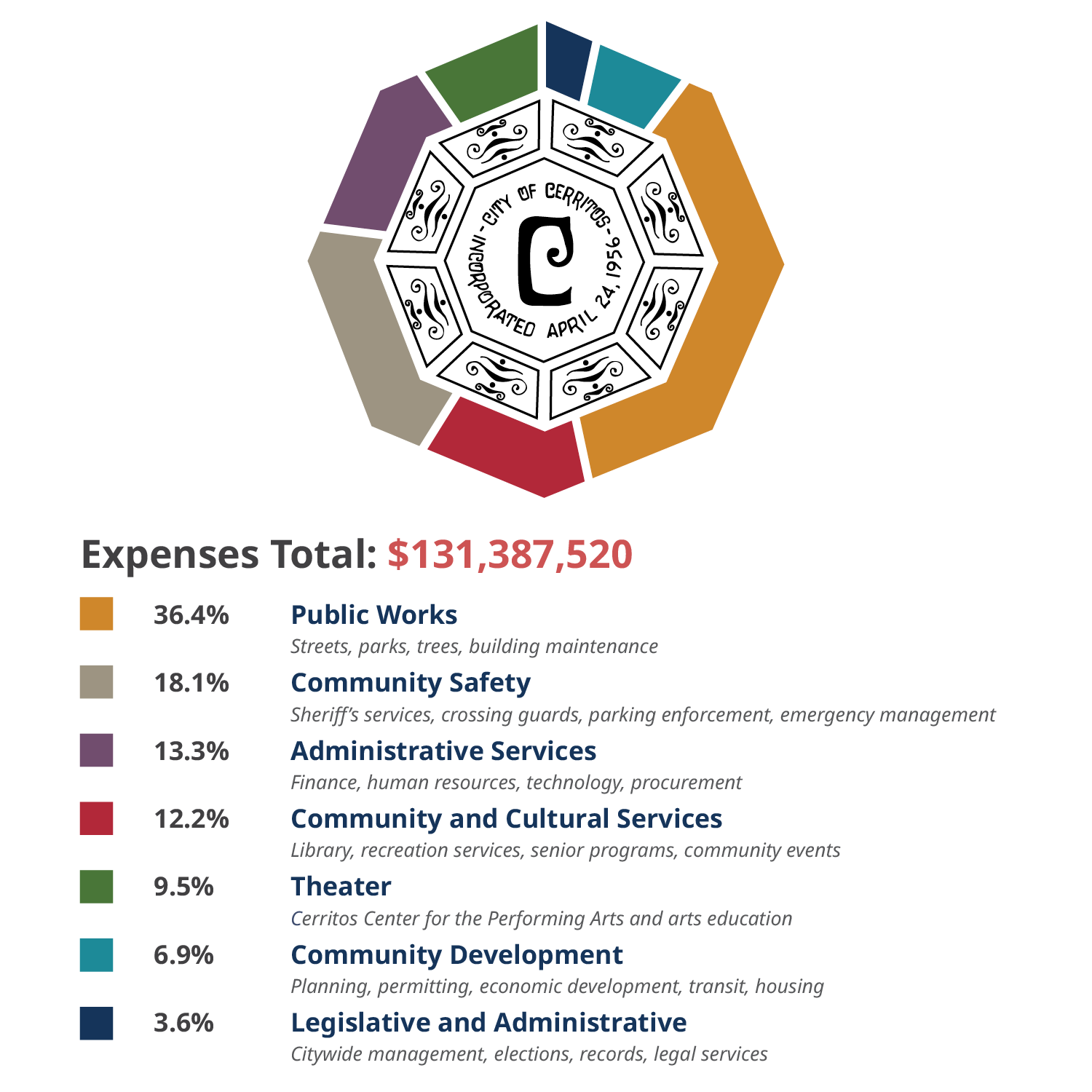

Expenses

The City’s Fiscal Year 2025-2026 projected citywide departmental expenses total is $131,387,520, supporting services such as public safety, street maintenance, water operations and community programs across all funds.

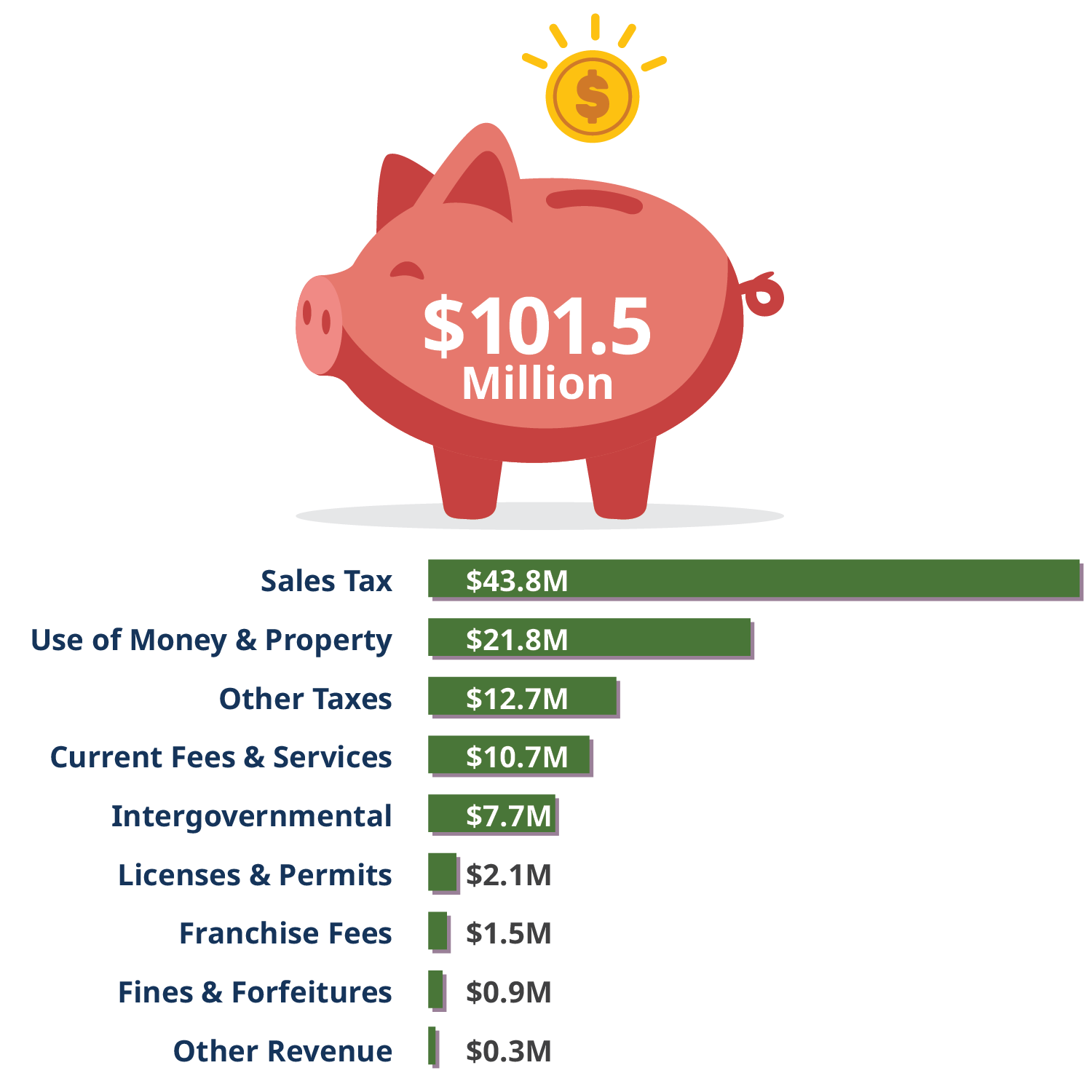

General Fund Revenues

The General Fund is one of multiple revenue streams to support City expenses and is Cerritos’ primary operating fund, with $101,503,081 in projected revenue for FY 2025-2026. Sales tax is the largest revenue source, representing nearly half of total General Fund revenue.

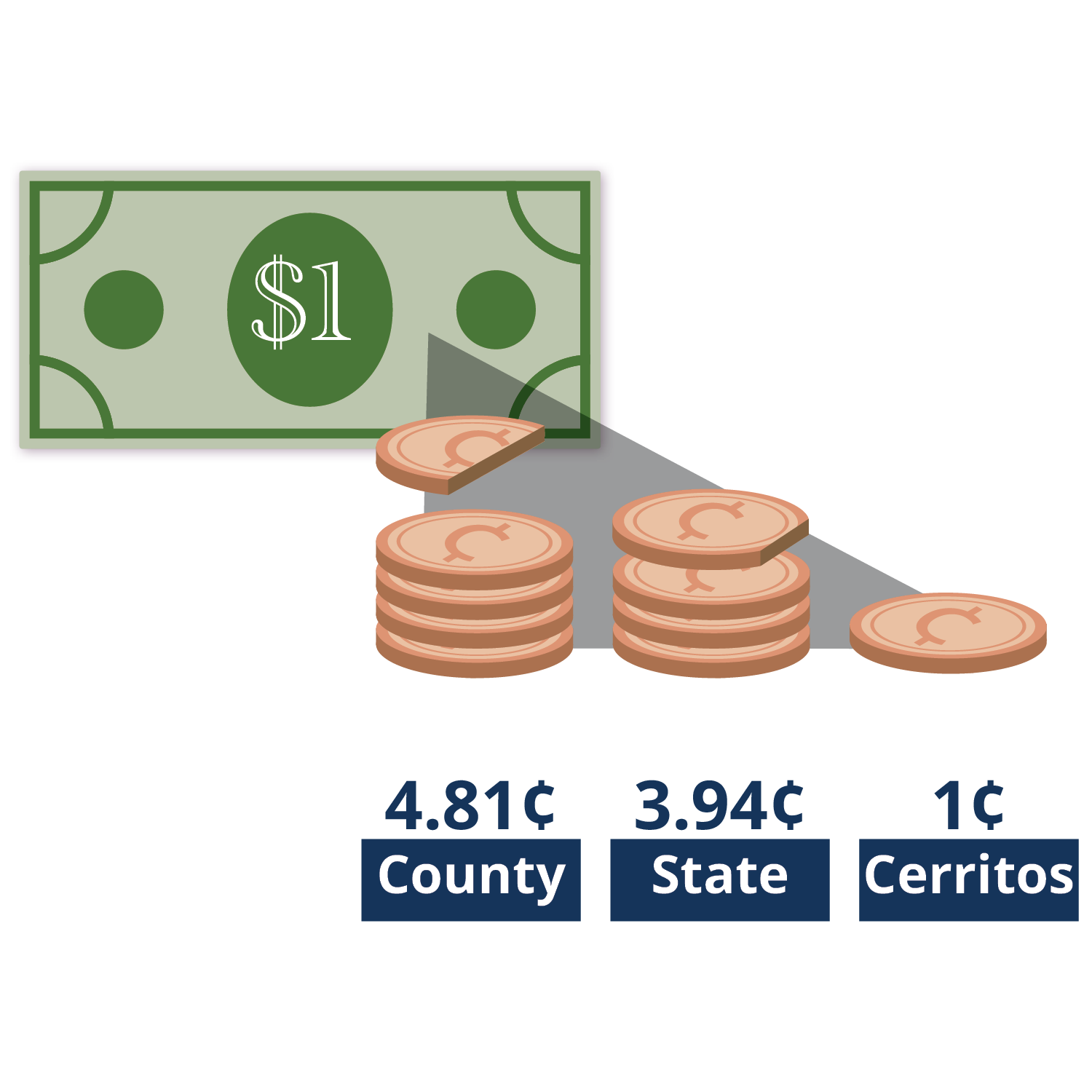

Sales Tax Allocation

Sales tax revenues play a crucial role in the City’s ability to fund core services. Out of the 9.75% sales tax paid by consumers, the City currently receives 1%. This means that, for every dollar spent in Cerritos, the City receives one cent. Sales tax revenue directly funds important citywide services, including sidewalk and tree maintenance, recreation and library programs, and crime prevention.

Budget Timeline

The annual budget process begins several months prior to the new fiscal year and includes multiple budget study sessions between City staff and the Cerritos City Council. The process concludes with a public hearing and formal budge adoption.

FY 2025-2026 Timeline and Activity

July 1, 2025: Fiscal Year 2025-2026 begins

June 26, 2025: Public Hearing and Budget Adoption; Cerritos City Council meeting

May 7, 2025: Budget Study Session [#], Cerritos City Council

March 27, 2025: Budget Study Session [#], Cerritos City Council

FY 2026-2027 Budget Timeline and Activity

December 11, 2025: Budget Study session #1; Cerritos City Council meeting

May 11, 2026: Budget Study session #2; Cerritos City Council meeting

June 8, 2026: Budget Study session #3; Cerritos City Council meeting

June 22, 2026: Public Hearing and Budget Adoption; Cerritos City Council meeting

July 1, 2026: Fiscal Year 2026-2027 begins

Frequently Asked Questions

How does the City of Cerritos generate revenue?

The City collects revenues through multiple methods which are distributed to different fund types. Those funds pay for certain services to support Cerritos residents, businesses, and visitors. The General Fund is the City’s primary operating fund, with nearly half of the fund accounting for sales tax revenues. Cerritos is a “no low” property tax city, so a small percentage of property taxes contribute to the General Fund. Other revenue sources include the City’s Enterprise Funds, such as the Water Fund and Sewer Fund. Enterprise funds are general paid for by user fees.

What is the current sales tax rate in Cerritos?

Cerritos has a sales tax rate of 9.75% and the City keeps 1% of that total amount. That means if you buy an $8 coffee or boba drink from a local cafe, the City receives 8 cents from the sales tax on that drink. If you’re someone who picks up the same drinks weekly, the City would receive 32 cents over the course of a month. By comparison, nearby cities like Bellflower receive 1.75% from their 10.5% sales tax rate. For the same $8 coffee or boba drink, cities like Bellflower receive 14 cents from the sales tax on that drink, or 56 cents over the course of a month.

How much annual revenue does the City generate from sales tax?

The City of Cerritos is projected to generate $43.8 million in sales tax revenue during the 2025-2026 Fiscal Year. Sales tax is one of the community’s main funding sources, helping support essential services such as public safety, street maintenance, parks, and community programs. Residents and visitors alike contribute to the City’s sales tax revenues, whether they’re purchasing everyday household goods at Cerritos Towne Center or shopping at a department store at Los Cerritos Center.

What does it mean for the City of Cerritos to be a “no low property tax” city?

Cerritos is considered a “no low property tax” city, meaning the City receives a smaller share of property tax revenue than surrounding cities. As a result, the City relies on other revenue sources, such as sales tax and fees, to support essential services for the community.

For More Information

Visit the Budget and Finances webpage, or contact the Finance and Budget Division by calling the Administrative Services Department at (562) 916-1355 or submit a notice through the online form.

Jump to: Top of page